The Surrey Board of Trade sent out a survey to its members asking for their thoughts on the Canada Emergency Business Account (CEBA) loan repayment requirements.

The survey found out that CEBA loan repayment has proven to be a double-edged sword for businesses, inflicting negative impacts that ripple through various sectors of the economy. As some businesses grapple with the financial burden of repaying these emergency loans, a disconcerting trend emerges, marked by closures, stalled expansion plans, employee layoffs, and a general scaling down of operations.

The CEBA was introduced as a financial aid initiative by the Canadian government to support businesses during the economic uncertainties triggered by the COVID-19 pandemic. While the program initially provided a lifeline for many businesses, the repayment phase has brought forth a set of challenges.

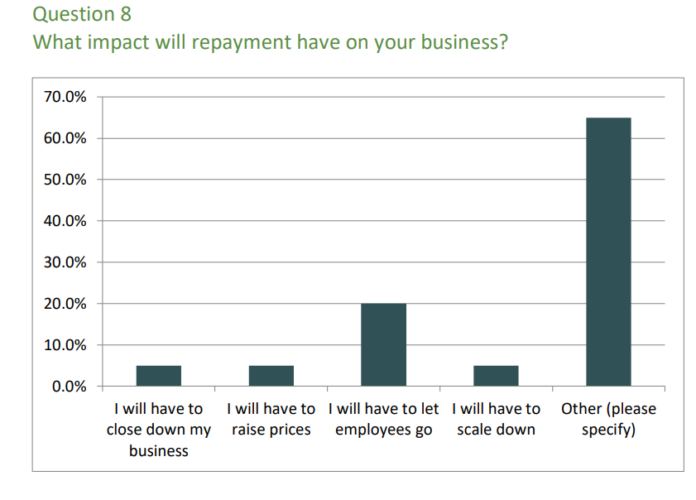

The report highlights that businesses are experiencing difficulties as they try to come up with ways to repay the loan. Some revealed that they will have to lay off employees, scale down their business, close their business, or take out other private loans to pay back the CEBA loan and address other rising cost pressures.

“Initial responses show that our members who took out a CEBA loan during the pandemic indicated that the payback mechanism is negatively impacting their businesses,” said Anita Huberman, President & CEO of the Surrey Board of Trade. “Not only did some businesses indicate they have had to lay off employees, but some may also even need to close their business altogether. The current economic environment is that of limited growth, and expecting small businesses to pay back this loan at this time is going to further put a strain on small businesses.”

The largest number of respondents in the survey at 20% indicated they fall in the professional, scientific and technical services, and the real estate and rental and leasing categories. The next highest number of respondents come from finance and insurance (15%).

The survey found out Of those that did take the loan, 86.6% had already started the repayment process.

“As some businesses navigate the tumultuous terrain of CEBA loan repayment and increasing costs, the repercussions are felt not only in boardrooms but also in the broader community. Layoffs contribute to unemployment rates, closures erode local economies, and the overall economic slowdown perpetuates a cycle of financial uncertainty. The overarching impact underscores the need for nuanced policy responses, tailored financial support, and proactive measures to mitigate the adverse effects on businesses, safeguard employment, and stimulate economic recovery,” added Huberman.